One of the key benefits of registering assets and maintenance operations in your ERP system is that you track all operations in one place – without costly integrations between systems. That also reduces the points, the same as in maintenance, potential breaking points. The ERP systems allow to register fixed assets and the financial transaction related to them such as acquisition, deprecation, increase or decrease of the asset's value, or, at the end of its life, dispose of the fixed asset.

Fixed Assets or Maintenance Assets?

However, even if fixed assets and maintenance assets have a close relation, not all fixed assets are maintenance assets in the organization and vice versa. On the one hand, it can be due to accounting principles in the country. For example, fixed assets are treated assets that the cost is higher than a certain amount. And from the other side, one fixed asset needs to be divided into more components that need to be maintained separately because of their characteristics.

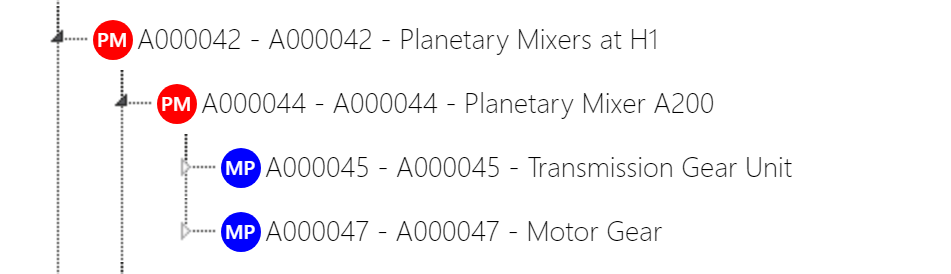

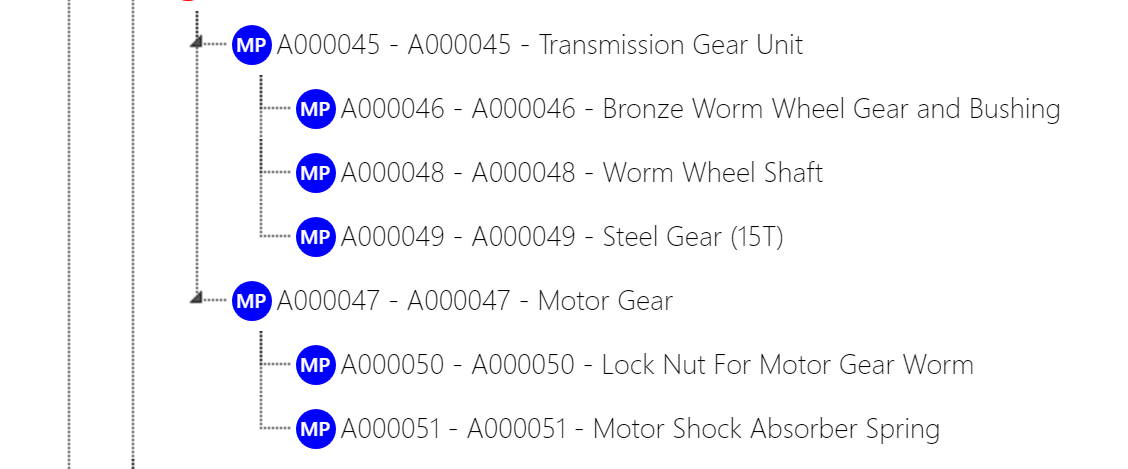

The example you can see below. The finance department decided that from an accounting perspective, they need one fixed asset – Planetary Mixer.

From an operational point of view, the maintenance team would like to be able to do the maintenance for components such as Transmission Gear Unit and Motor Gear Unit.

They also want to be able to track all operations on the lower level. So, the Transmission Gear and the Motor Gear have been divided to even more components. All of them are not needed as fixed assets since they are treated as part of the machine.

How to track maintenance costs properly?

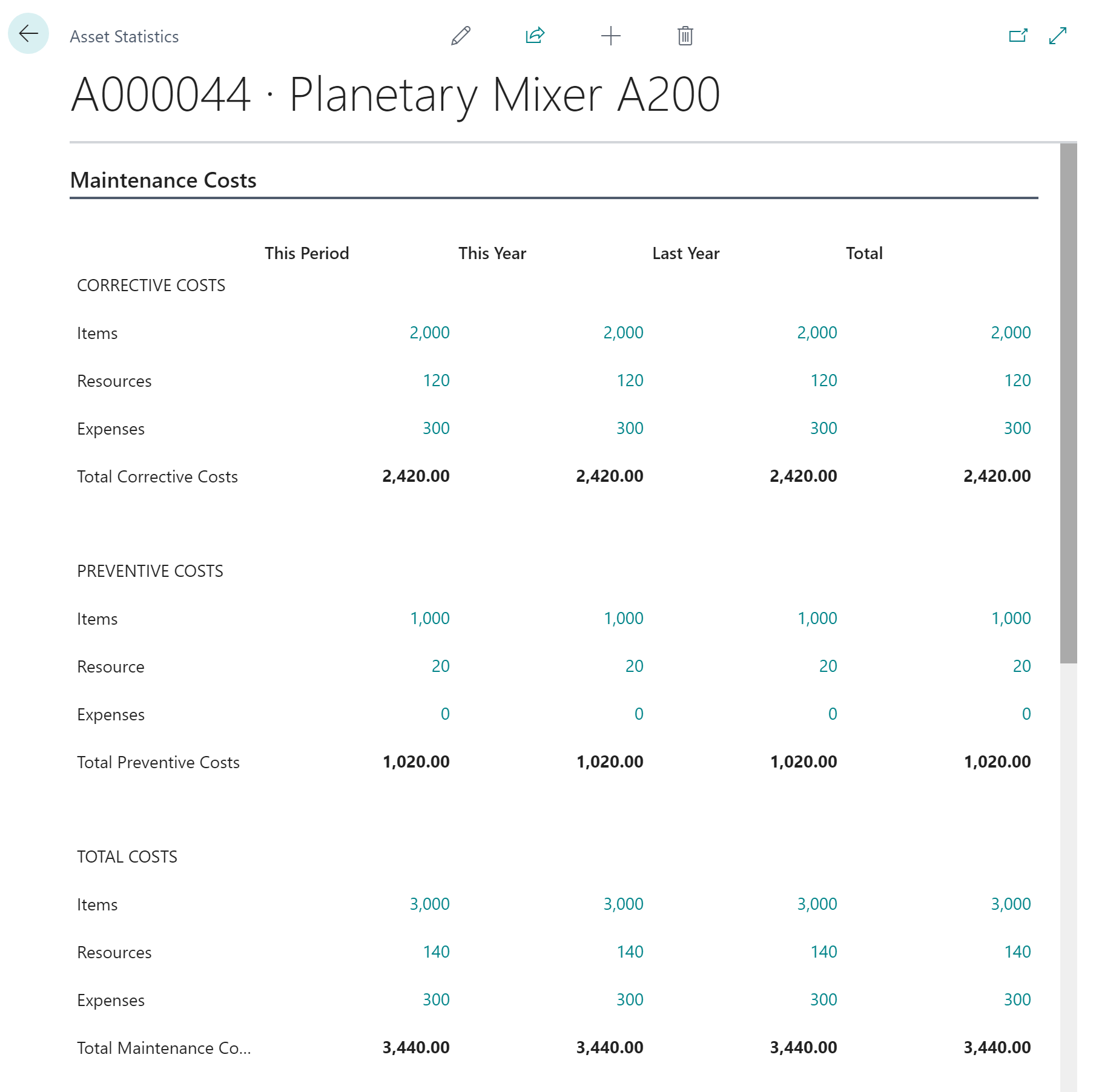

The maintenance department needs a more detailed utilization costs breakdown for the asset on the component level. It is essential to know if the costs posted for the asset are related to the spare parts (called in Microsoft Dynamics 365 Business Central items), costs related to technicians (internal company resources), or all other external costs such as contractors. Also, it can be necessary if the cost comes from ad-hoc repairs (corrective actions) or scheduled and planned maintenance (preventive maintenance).

Tracking the costs from the Fixed Asset perspective

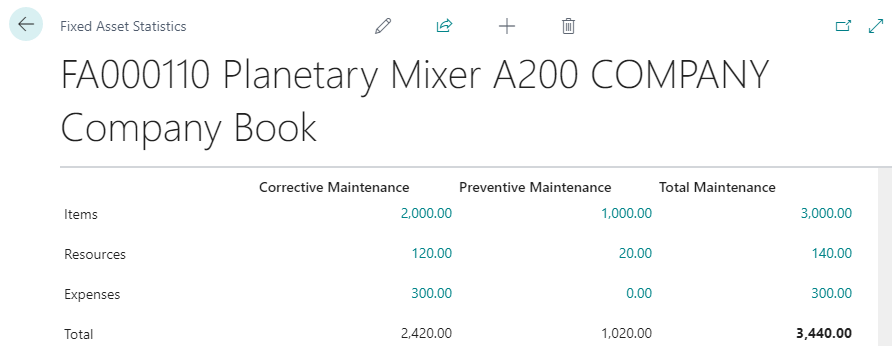

One thing that is common for both departments, finance and maintenance, is the ability to see the costs of repair or maintenance of the assets. From the accounting point, the overview of the costs is enough – in other words, it is not needed to see what the maintenance cost of Steal Gear in the example is, but the accountant focuses on the general costs of the Planetary Mixer.

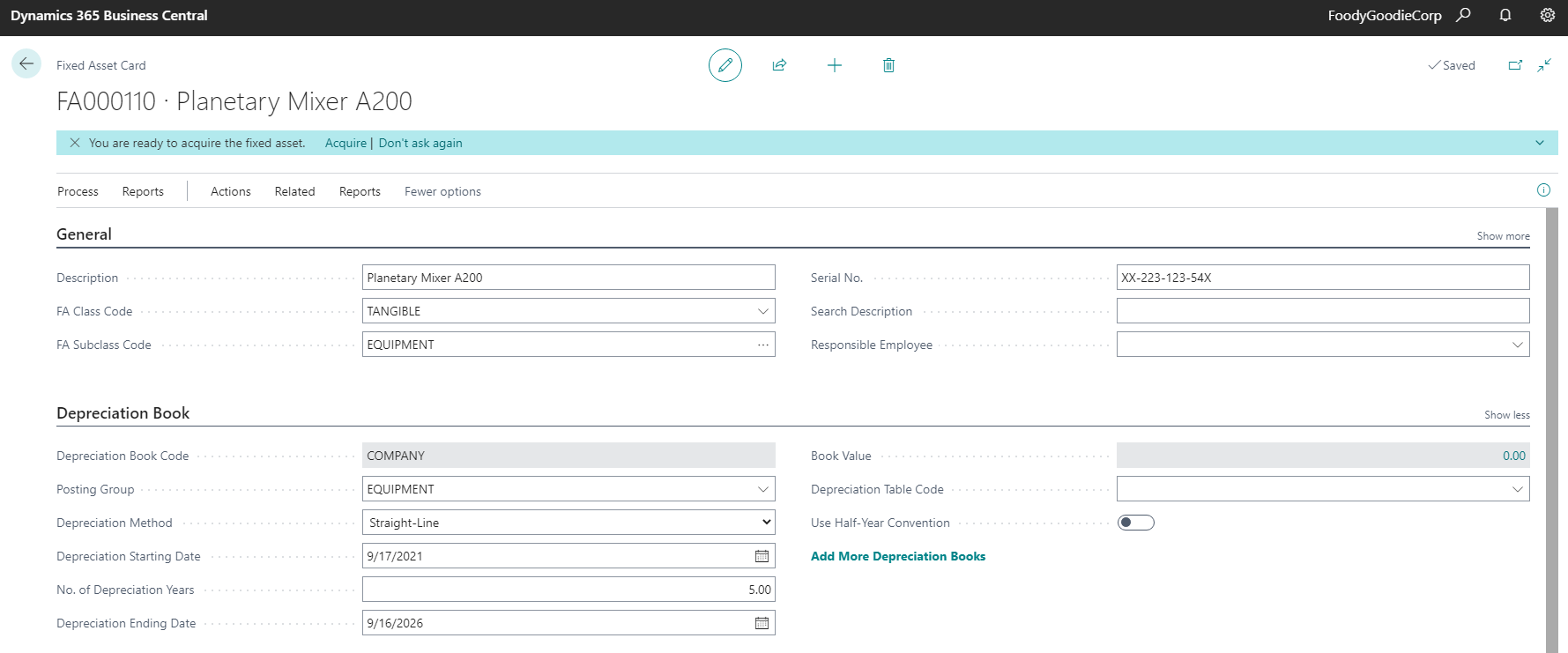

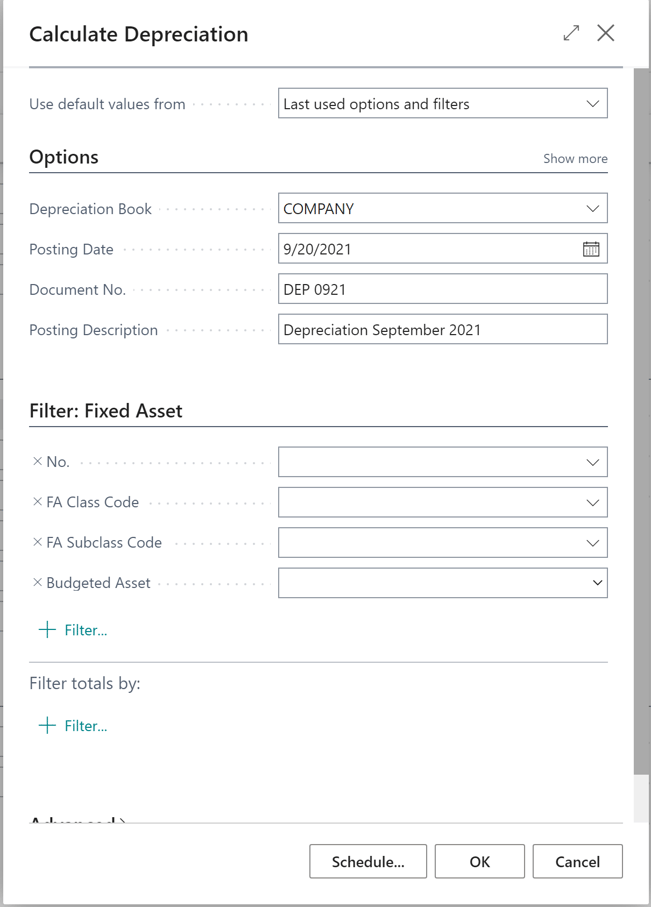

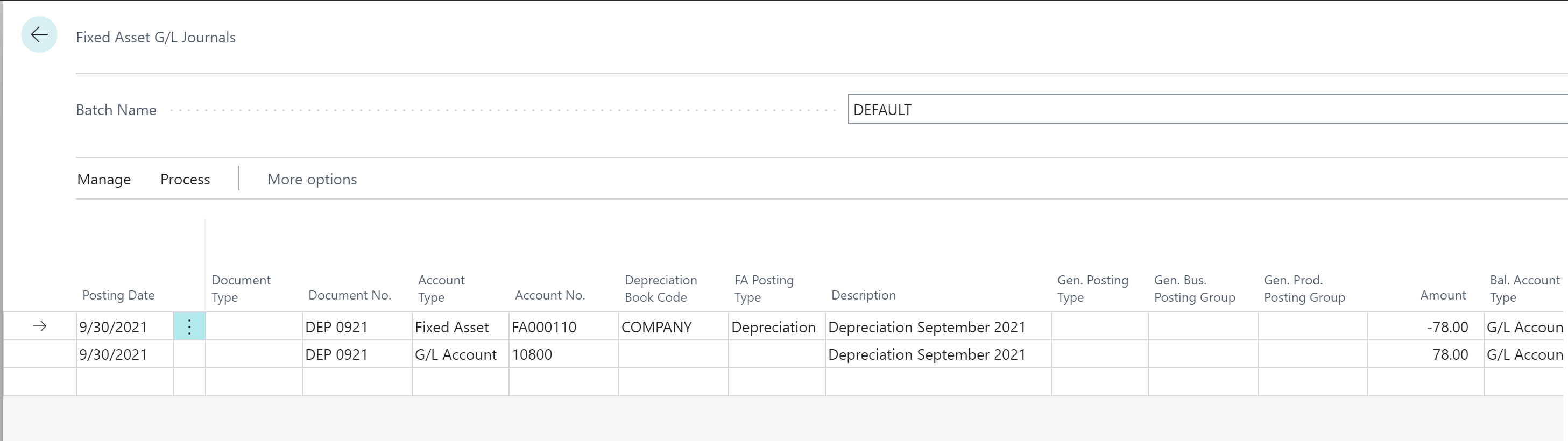

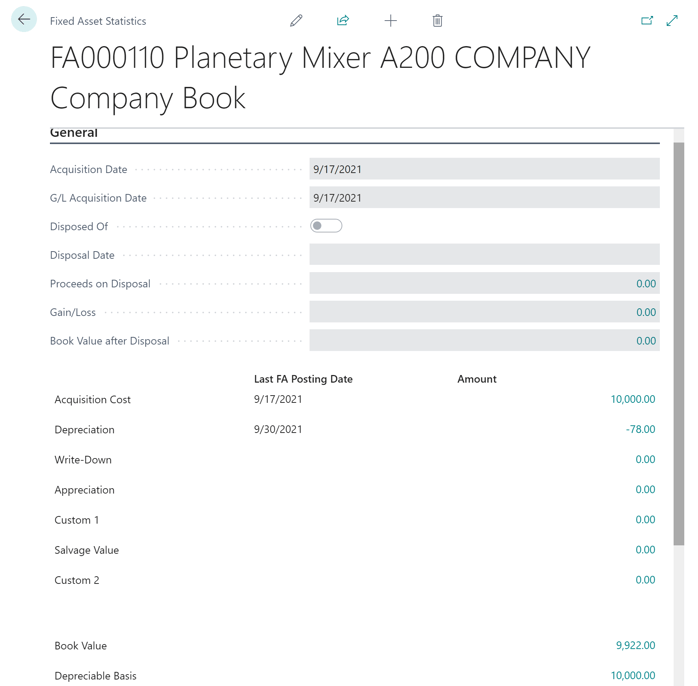

From a finance perspective regarding fixed assets, it is required to be able to post to the general ledger entries related to acquire of the asset and be able to calculate the depreciation of the asset. There is more than one depreciation book in some cases – for example, statutory reporting, organization reporting, or tax reporting.

ERP Systems such as Microsoft Dynamics 365 Business Central can help in all those operations. With simple few clicks, it is possible, for example, to calculate and post depreciation of the fixed asset. It is also possible to calculate depreciation for the deprecations books that are not connected with the general ledger.

After the operations are posted, all costs can be shown on the statistics and reports inside Business Central.

Creating assets. Who should do it?

Maintaining fixed assets and maintenance assets in the computer system can be easier if both functionalities are part of the same system and no integration is required. Depending on the process in the organizations (sometimes depending on local rules), there are two scenarios.

In the first one finance department starts the process by creating the fixed asset and letting know that the asset can be used in the maintenance. However, there can be situations that maintenance is the first department that knows about the asset.

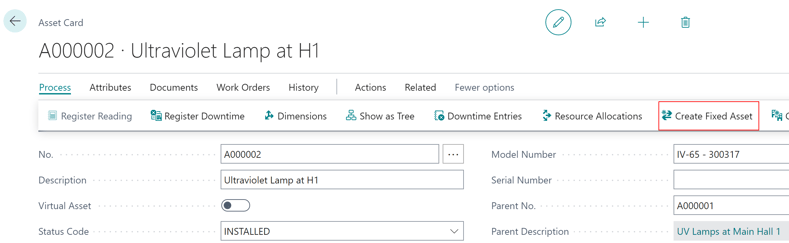

In Dynaway EAM for Dynamics 365 Business Central, we try to support both scenarios. If the finance team is required to create the asset based on maintenance assets, then they could do it from the Asset Card.

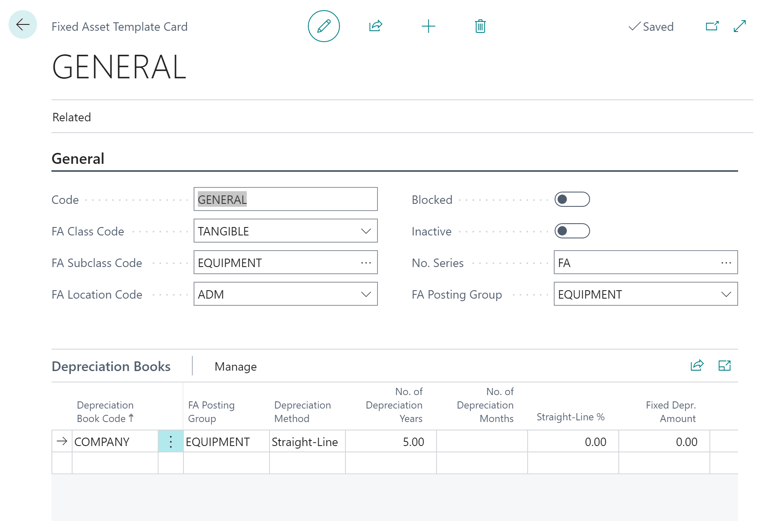

The fixed asset will be created based on the template prepared before. An account manager can decide on a basic setup for the asset such as depreciation books, fa class, location, or posting group. The dimensions will also be copied between cards.

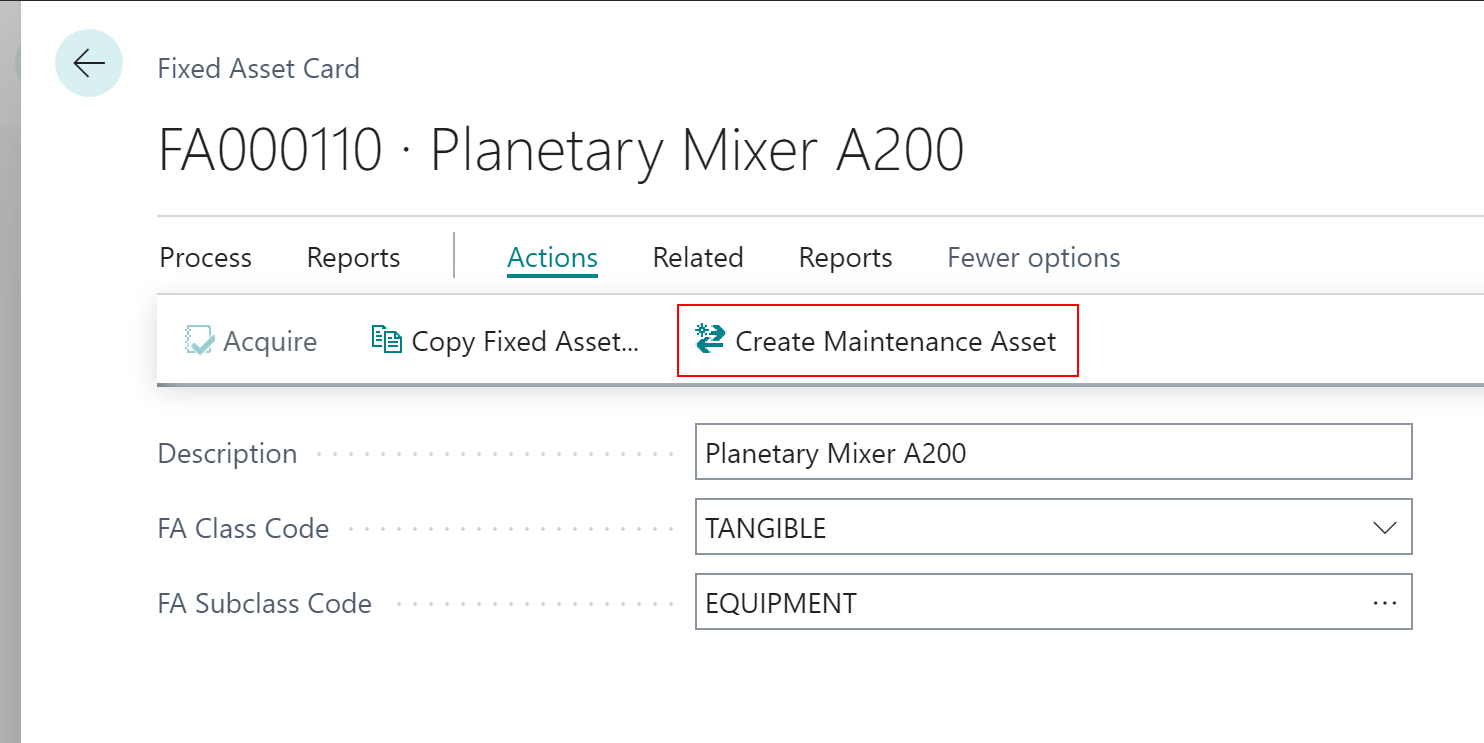

If the asset is created first in the finance department, the maintenance or finance manager also has the possibility to create a maintenance asset directly from a fixed asset card.