When doing maintenance, it’s not uncommon to have expenses and additional costs such as tool rental, accommodation, and travel expenses that needs to be registered. In this article, you will learn how to register the costs and book them against the related job and asset.

In Dynaway EAM for Business Central, it is possible to create expense cards. In general, expenses are all your costs that are not internal or are not spare parts (that you have in stock or purchase from vendors). For bookkeeping purposes, it’s important that you get a separate invoice from your vendor for such cost (for example for hotel expenses, consulting services and any part used by external service contractors).

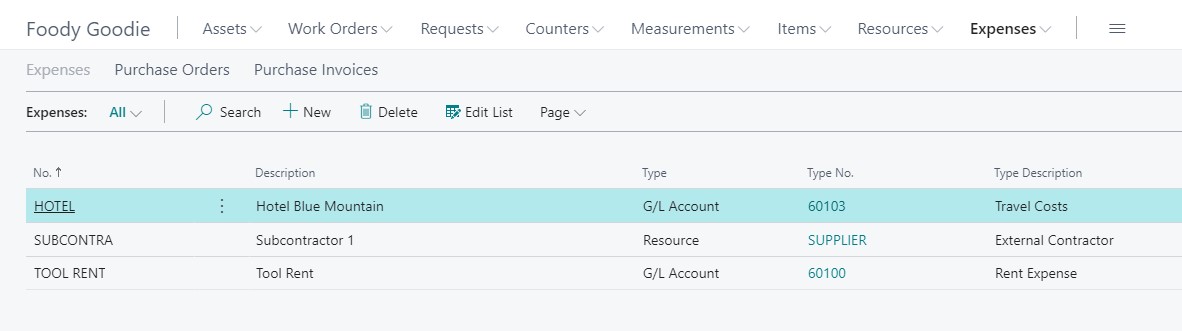

Setup for expenses

Since your maintenance team does not need to know how to book the costs in your financial ledgers the best is to create a dictionary of expenses together with your finance department.

You can easily map the expenses to resources, service items, or G/L Accounts. This would ensure that the costs will be posted correctly in your financial ledgers in Dynamics 365 Business Central.

Register Work Order Expenses

Expenses can be registered on each work order. This ensures that your team can analyze not only the individual expense but also the aggregated cost statistics for the Asset or Work Order Plan.

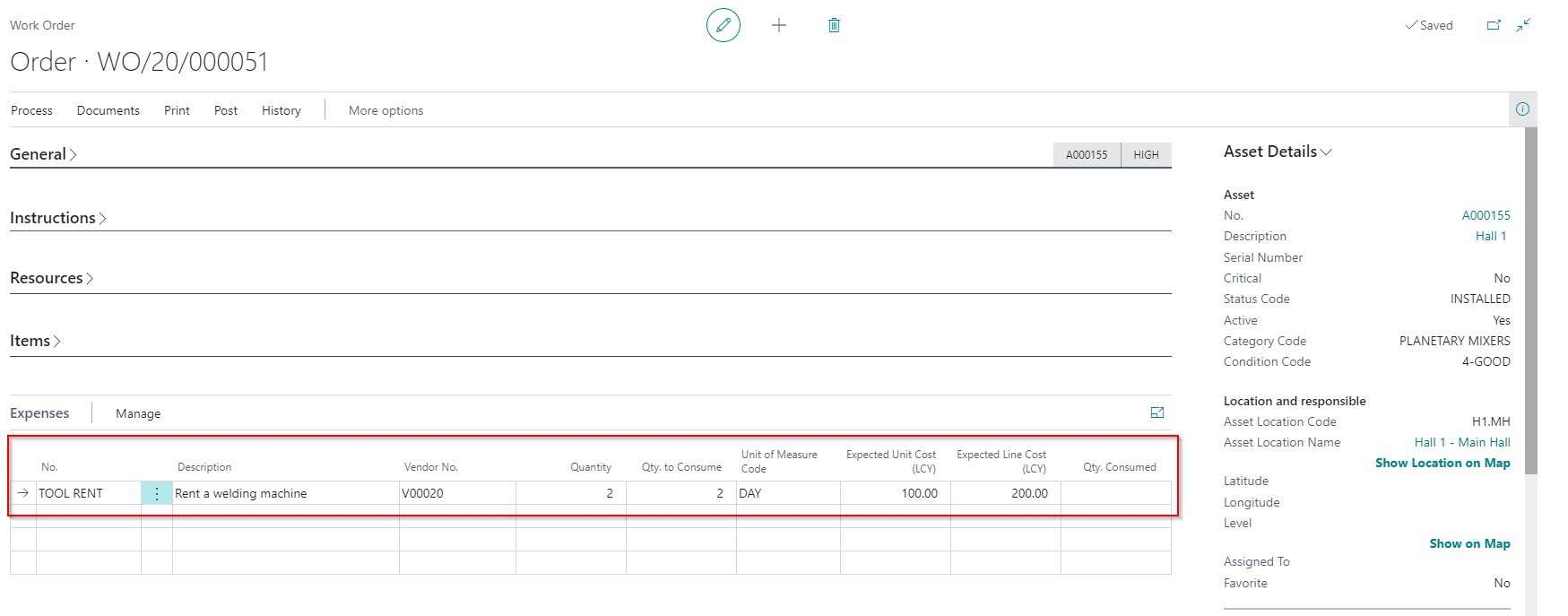

In the example below from Foody Goodie company, you can see that the team needed to rent a welding machine to execute the work order. They did not have any working at the moment, so they register the costs on work order WO/20/00051. A technician chose a Tool Rent expense and change the description to give more information on why the cost was needed.

A technician also needed to choose from which company (vendor number) he rented the welding machine. The cost for a day is 100$ (which is a company's local currency), so the technician put proper expected costs and how many days he needed to use the tool.

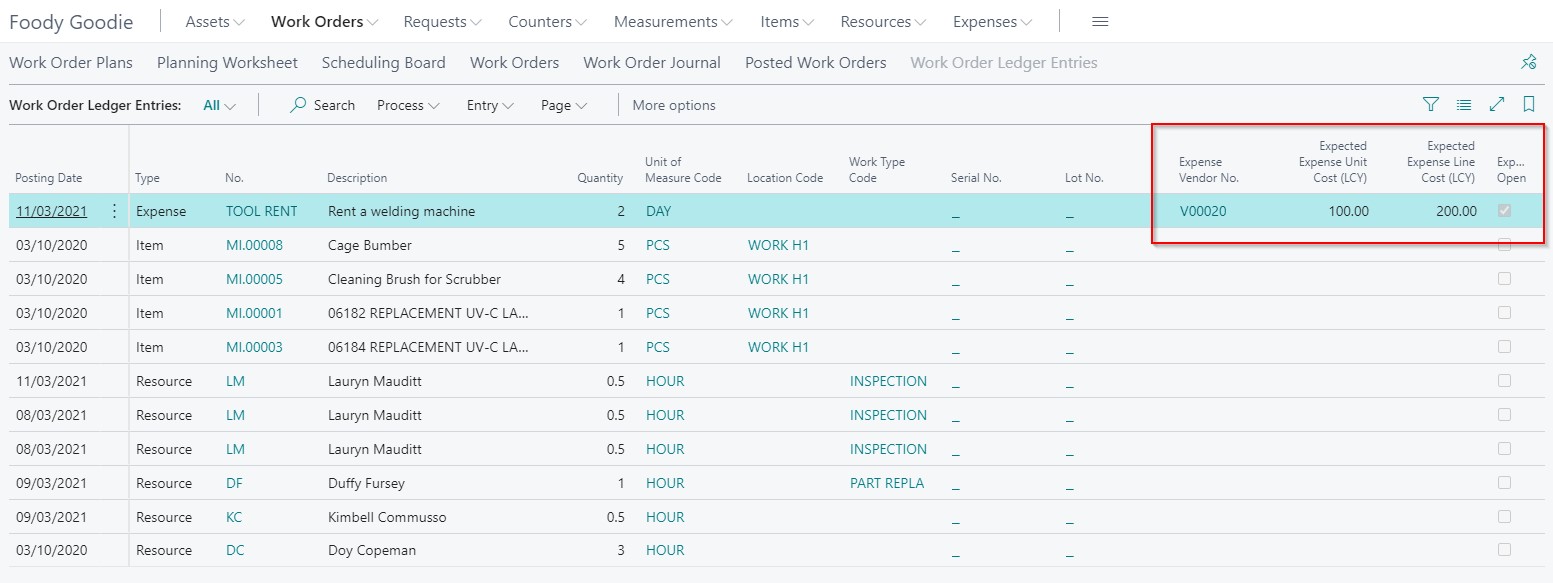

After a technician register the costs in the Work Order Ledger Entries there is a new line for the expense. At this moment on the line, it is possible to see the expected cost for the expense and which vendor will issue the invoice for the company. The expense is marked as open which means that the invoice is not yet registered for the line.

Post Purchase Invoice for the expense

Foody Goodie company has an agreement with some vendors to get only one invoice for the whole month.

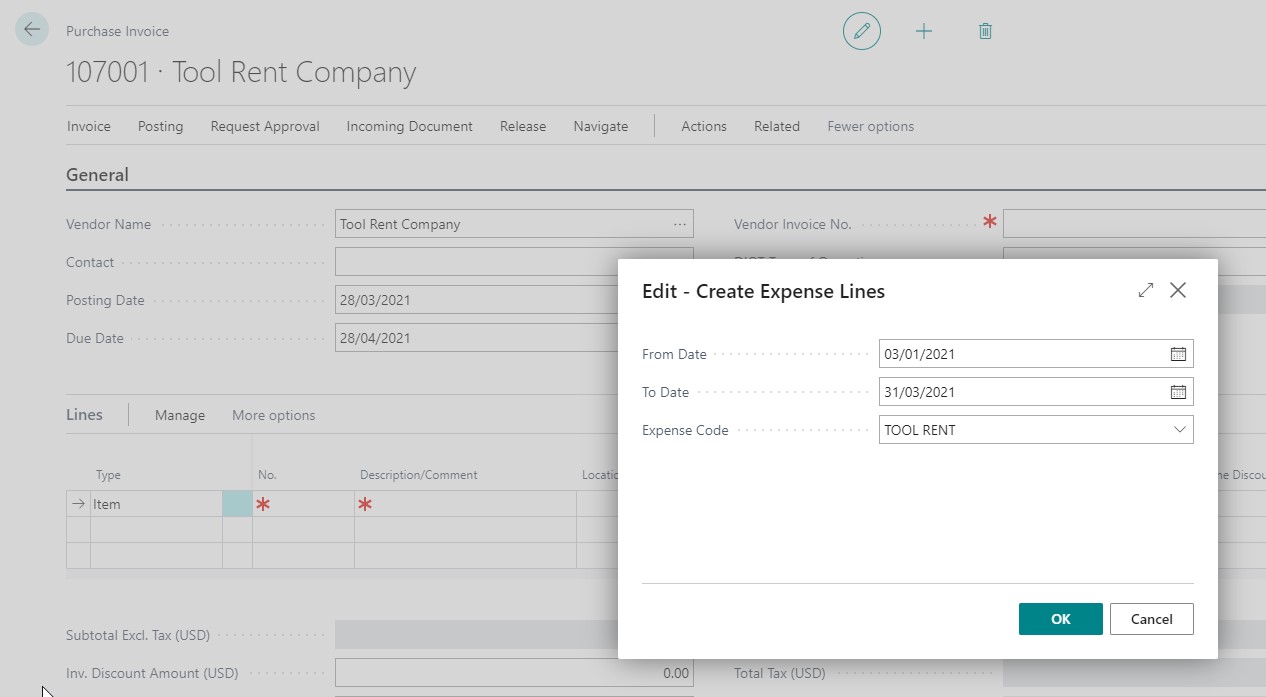

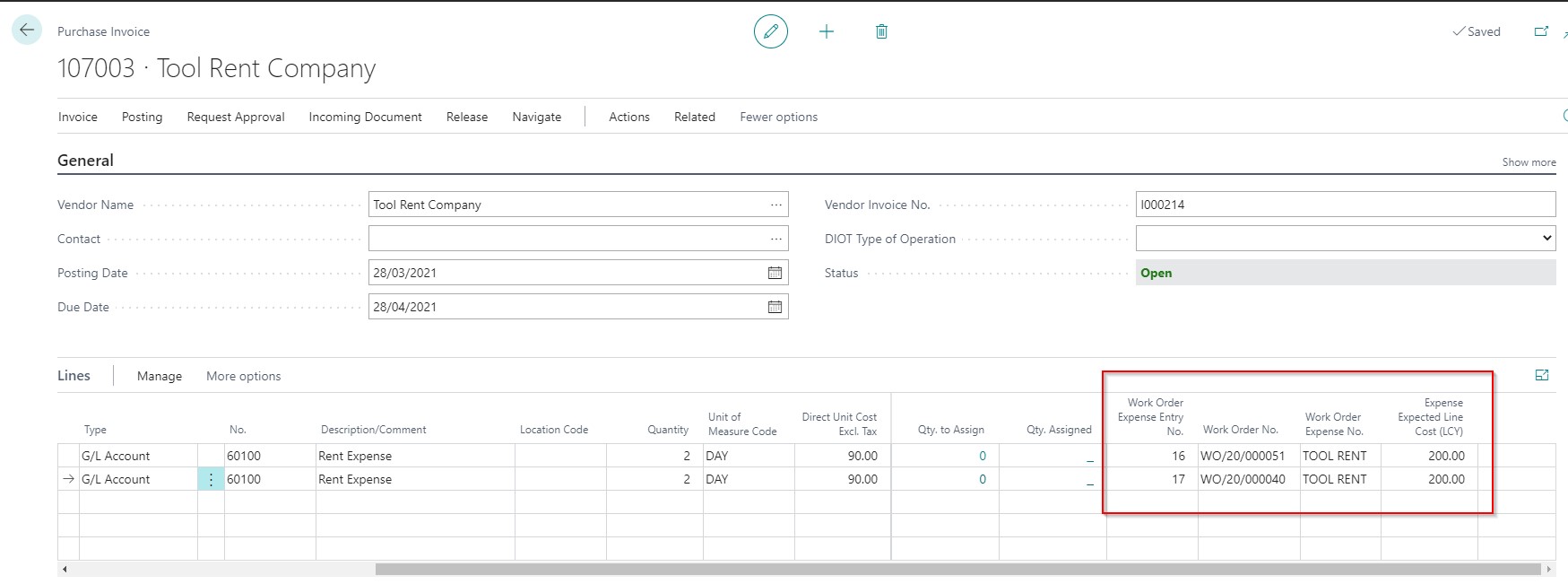

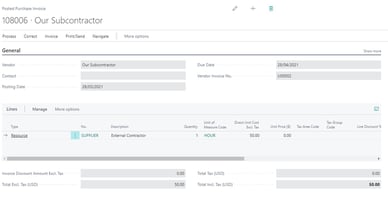

A finance team got the invoice from Tool Rent Company for the whole month for all tools which they needed in the month. Instead of register cost manually the person who registers the invoice can use a special action to retrieve all work order lines which has been registered this month. In the document, the accountant can see for which work orders the expense has been added and can see the expected costs.

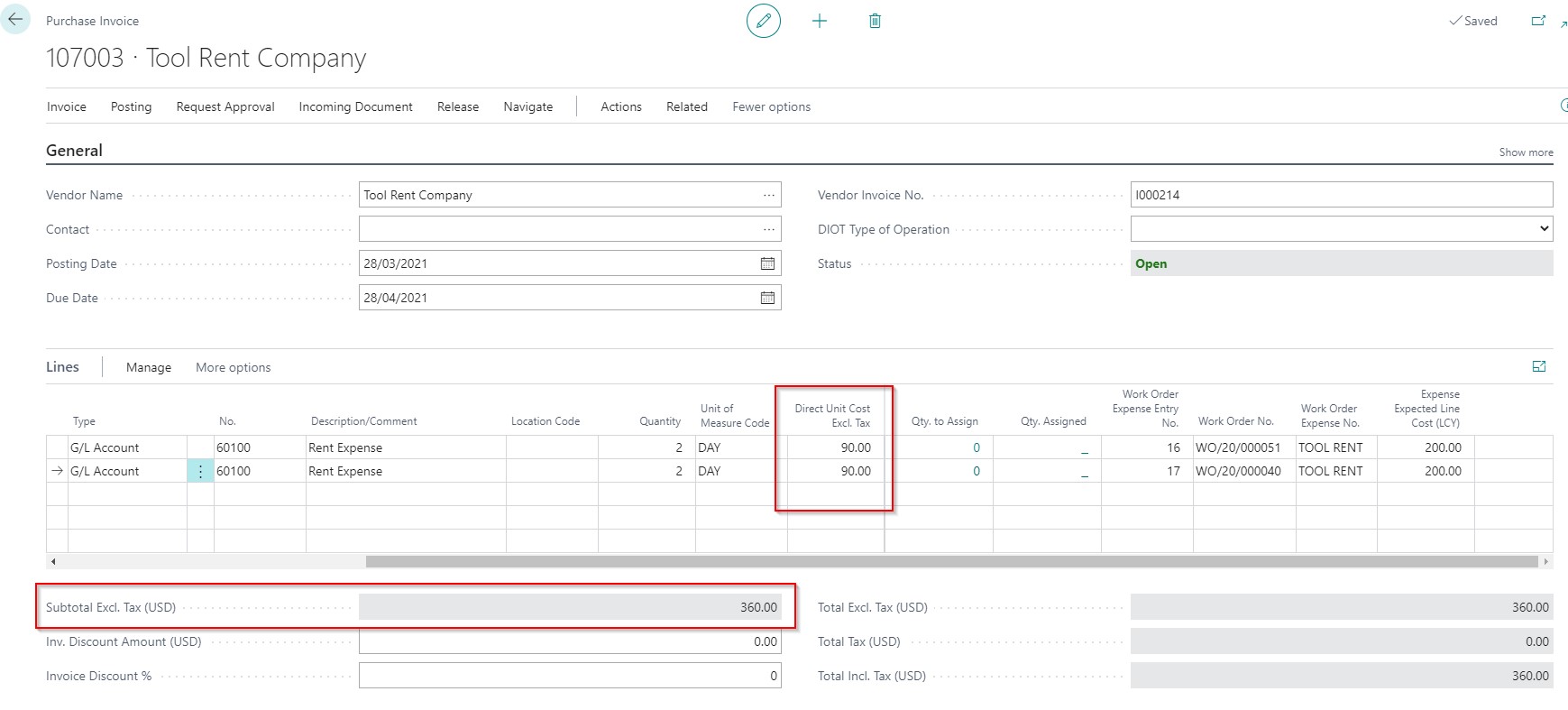

Register Discounts

Since the Foody Goodie company has a good relationship with the Tool Rent Company, they got a 10 percent discount this month. The technician, when register the cost, did not know that but the accountant can apply the discount for the invoice by changing the Direct Unit Cost. Instead of paying 400$ for tools, the company needs to pay only 360$.

Now in Dynaway EAM Work Order Ledger Entries, it is possible to see what the actual cost of the expense is.

What if you get two invoices for one expense?

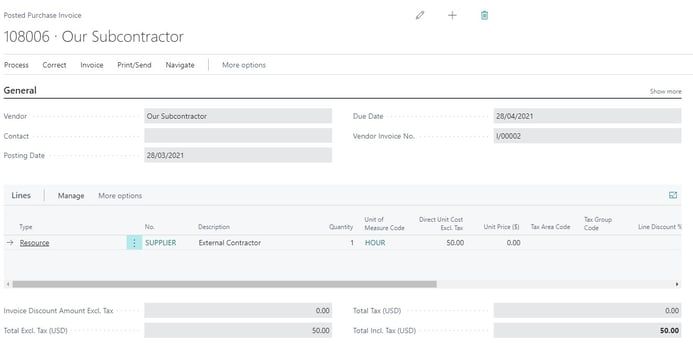

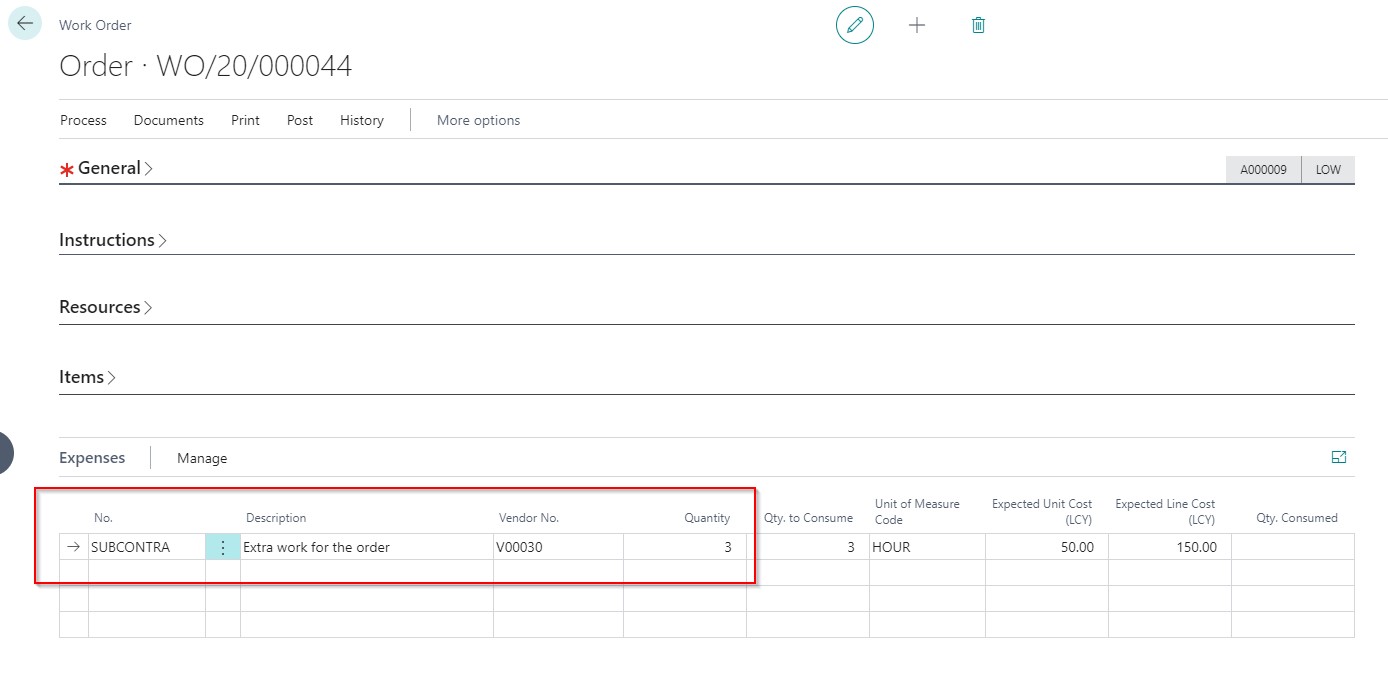

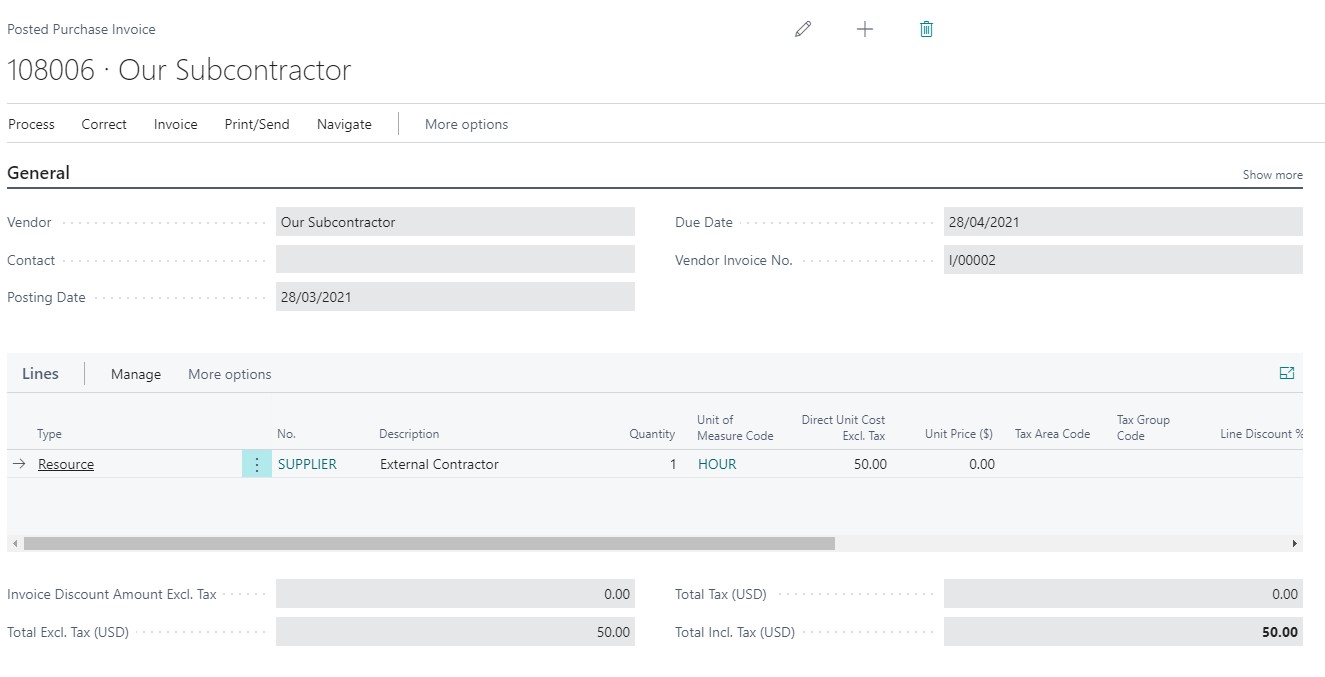

Foody Goodie uses also one of the subcontractors for some special works. In this case, the work order required 3 hours of extra work for which the company will get the invoice.

The subcontractor issued the invoice only for two hours but later he realized the mistake and sent another invoice for an additional 1 hour. The accountant was able to register the next hour for the same expense – he could put the line manually but also function used previously will get for him the expense lines. After posting the expense lines in the work order ledger entries will have correct values.

What if you get a credit memo?

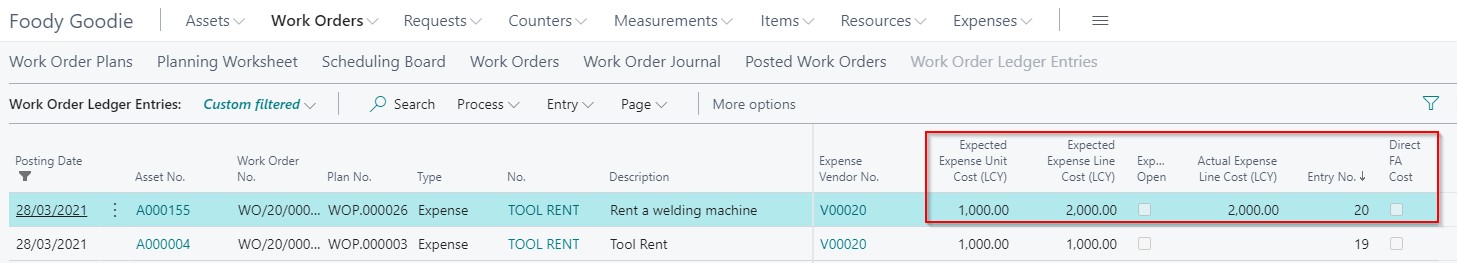

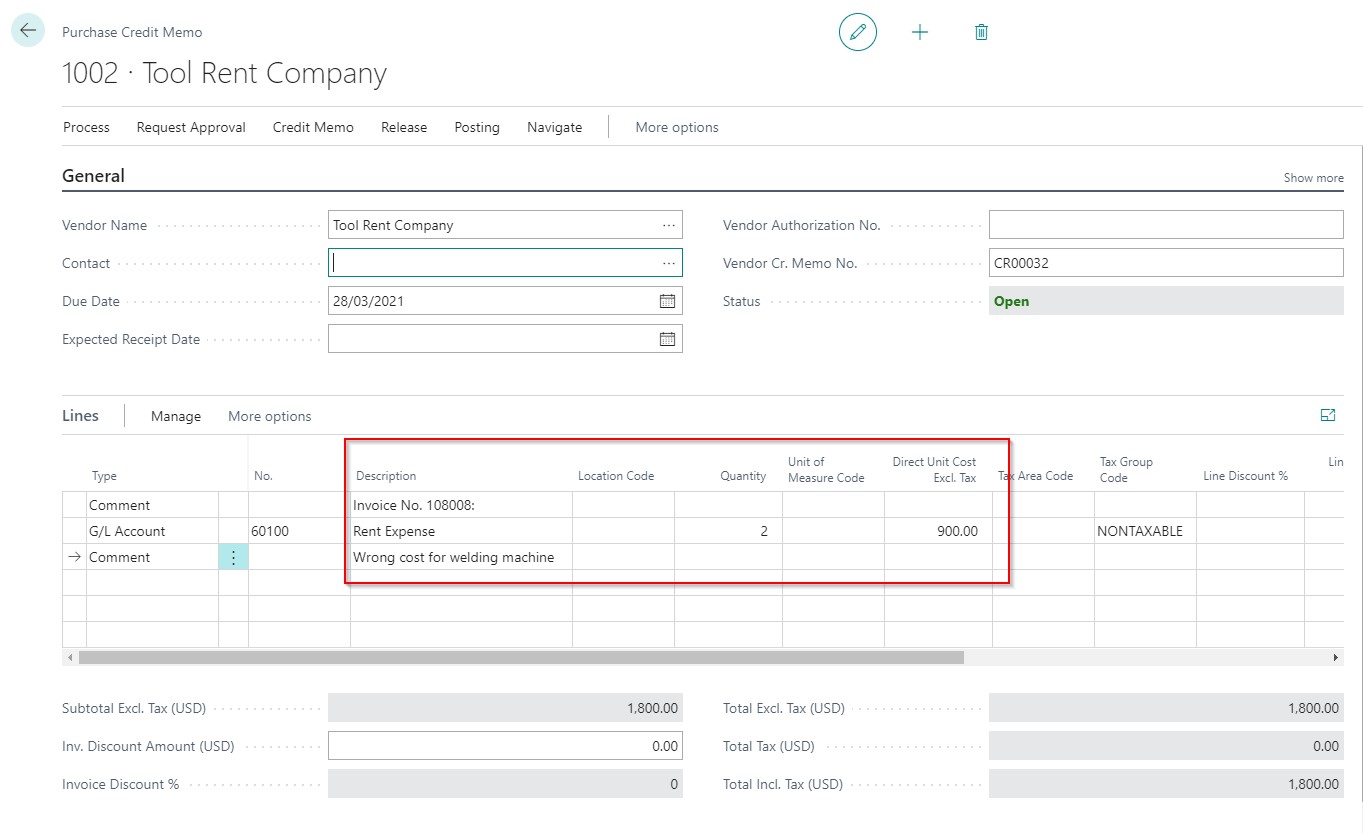

Foody Goodie got the invoice from the vendor for renting the welding machine and the accountant post the costs.

But the Tool Rent Company, the vendor, realized that they charged 1000$ per day instead 100$. The vendor issued the credit memo for 1800$ to match the costs.

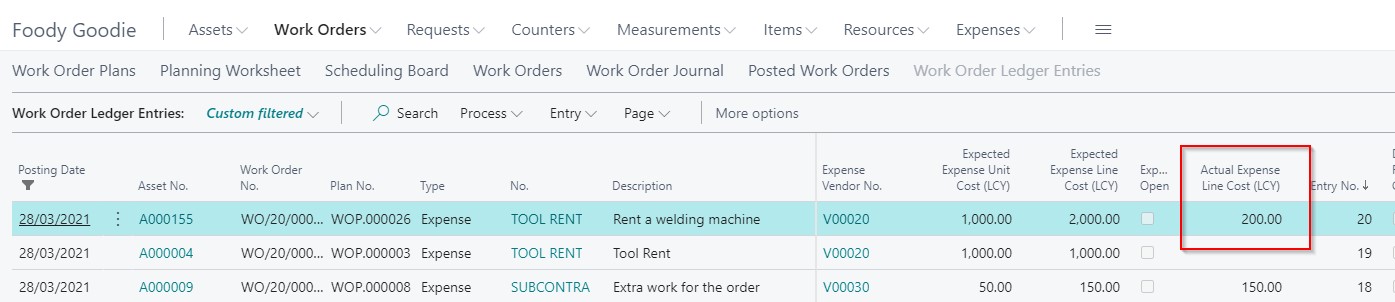

After posting the credit memo the actual cost for the expense in the Work Order Ledger entries has been corrected from 2000$ to 200$.

How to post the invoice for expense step by step

As you can see the posting the invoice for external maintenance costs is very easy in Dynaway EAM. To do so you can follow below steps:

- Together with the finance team create an expense list.

- Add the expense on the work order and put who will send the invoice and what is the expected cost for the expense.

- Create the purchase invoice for the vendor and get related entries (also you can put them manually).

- Post the purchase invoice.

.png?width=388&height=200&name=Copy%20of%20Blog%20Feature%20Image%20(6).png)

.jpg?width=388&height=200&name=Digital%20transformation%20(4).jpg)